Latest News

As Digital Realty Trust has outperformed the Dow recently, analysts remain moderately optimistic about the stock’s prospects.

Via Barchart.com · March 6, 2026

May corn futures present a buying opportunity on more price strength.

Via Barchart.com · March 6, 2026

Shares of defense stocks Tat Technologies and Leonardo DRS rose notably this week, as the war in Iran continued.

Via Investor's Business Daily · March 6, 2026

Reitar shares rose after the company unveiled a potential $60 million equity investment to support a logistics acquisition strategy.

Via Benzinga · March 6, 2026

Gapping S&P500 stocks in Friday's sessionchartmill.com

Via Chartmill · March 6, 2026

Via Benzinga · March 6, 2026

Ondas expands counter-UAS deployments in the Middle East, enhancing defense capabilities for governments and critical assets.

Via Benzinga · March 6, 2026

Guidewire Software (GWRE) reported strong Q2 results, beating revenue and EPS estimates. It also raised its fiscal 2026 outlook, leading to a 4.7% increase in stock price. Analysts have mixed opinions, with some raising price targets and others lowering them.

Via Benzinga · March 6, 2026

MercadoLibre's accelerating user growth and expanding ecosystem may be setting up a powerful long-term opportunity. Here is what investors need to understand before the next move.

Via The Motley Fool · March 6, 2026

Korn Ferry (NYSE: KFY) will report Q3 earnings on 3/9, with analysts expecting $1.24 EPS and $695.12M revenue. KFY raised dividend and closed at $65.08 on 3/5.

Via Benzinga · March 6, 2026

A Tesla billionaire whale's purchase of 1 million Nvidia shares lands just as the company reports record fiscal 2026 revenue.

Via Barchart.com · March 6, 2026

Via Benzinga · March 6, 2026

Confusion in the precious metals markets is hitting the gold stock.

Via The Motley Fool · March 6, 2026

With the right strategy, you can lower your risk of running out of money.

Via The Motley Fool · March 6, 2026

Dow Jones falls 500 points on Friday, Marvell Technology shares jump 18.4%, other stocks recording gains include DAWN, BATL, RCAT, and SWBI.

Via Benzinga · March 6, 2026

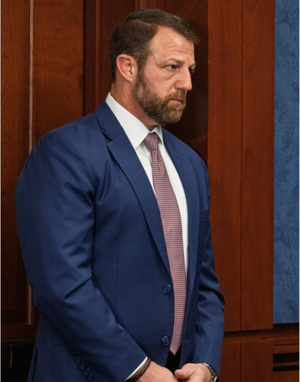

Markwayne Mullin has been named the next potential Director of Homeland Security by President Donald Trump. Here's a look at Mullin's stock trading history.

Via Benzinga · March 6, 2026

In a move that fundamentally reshapes the credit reporting landscape across the Americas, TransUnion (NYSE: TRU) officially completed its acquisition of a majority stake in the consumer business of Buró de Crédito, Mexico’s premier credit bureau, on March 2, 2026. By increasing its ownership from a minority 26% to

Via MarketMinute · March 6, 2026

Investors, drawn by Buffett's investment success over the years, turn to him for inspiration.

Via The Motley Fool · March 6, 2026

COLUMBIA, MD — In a financial performance that analysts are describing as a "tale of two balance sheets," BigBear.ai (NYSE:BBAI) released its fourth-quarter and full-year 2025 results this week, revealing a complex landscape for the defense-tech specialist. While the company successfully fortified its treasury and slashed nearly all of

Via MarketMinute · March 6, 2026

As the first quarter of 2026 draws to a close, a palpable shift in sentiment is rippling through the corridors of Wall Street. Major financial institutions, led by the industry bellwether JPMorgan Chase & Co. (NYSE: JPM), are navigating a complex transition from the "higher-for-longer" interest rate paradigm of previous years

Via MarketMinute · March 6, 2026

The dollar index (DXY00 ) today is down by -0.20%. The dollar is under pressure today from a weaker-than-expected US Feb payroll report. Also, a decline in US Jan retail sales added to negative sentiment toward the dollar. Losses in the dollar are...

Via Barchart.com · March 6, 2026

The Federal Reserve’s latest Beige Book, released on March 4, 2026, has revealed a starkly "bifurcated" U.S. economy, where a booming industrial sector is increasingly at odds with a "buckling" consumer-facing market. While regional growth in the Midwest and South remains robust—driven by massive investments in energy

Via MarketMinute · March 6, 2026

Ameriprise Financial stock has lagged the Nasdaq over the past year, while analysts remain moderately bullish about its prospects.

Via Barchart.com · March 6, 2026

March has just begun, and this under-the-radar AI stock has jumped over 50% in 2026. Should investors chase the surge, or is a cooldown around the corner?

Via Barchart.com · March 6, 2026

The market is filled with gapping stocks in Friday's session.chartmill.com

Via Chartmill · March 6, 2026

Do you need some extra monthly income? Here are four stocks that can help you earn $300 per month of tax-free income.

Via The Motley Fool · March 6, 2026

The global aviation sector is facing its most significant crisis since the post-pandemic recovery, as a "perfect storm" of surging jet fuel prices and escalating geopolitical instability in the Middle East threatens to derail industry profitability. Over the past week, the "Big Three" U.S. carriers have seen their valuations

Via MarketMinute · March 6, 2026

BioXcel Therapeutics shares fall after a rally as BXCL501 Phase 2 data show promise for treating opioid withdrawal symptoms.

Via Benzinga · March 6, 2026

MOUNTAIN VIEW, CA — In a move that signals the definitive end of the "walled garden" era for mobile software, a federal court on March 4, 2026, officially approved a comprehensive settlement between Alphabet Inc. (NASDAQ: GOOGL) and Epic Games. The agreement, which resolves nearly six years of high-stakes litigation, forces

Via MarketMinute · March 6, 2026

The regional amusement park operator sells assets at a discount, but it's the stock that moves higher.

Via The Motley Fool · March 6, 2026

Gap reported Q4 earnings below expectations, but management plans for long-term transformation in 2026. Analyst cuts PT but remains bullish.

Via Benzinga · March 6, 2026

As of March 6, 2026, the satellite telecommunications landscape has shifted from a realm of experimental prototypes to a high-stakes industrial frontier. At the center of this transformation is AST SpaceMobile (NASDAQ:ASTS), which has officially transitioned from a speculative research and development firm into a revenue-generating mid-cap growth juggernaut.

Via MarketMinute · March 6, 2026

After a Cabinet shake-up, here are 4 defense stocks for investors to watch now.

Via Barchart.com · March 6, 2026

In a week that many market observers are calling a watershed moment for the hydrogen economy, Plug Power Inc. (NASDAQ: PLUG) has unveiled a radical transformation in its business model, punctuated by a surprise return to positive gross margins and a changing of the guard at the executive level. Following

Via MarketMinute · March 6, 2026

On March 5, 2026, MongoDB, Inc. (NASDAQ: MDB) released its fourth-quarter and full-year fiscal 2026 results, reporting a 27% year-over-year revenue increase to $695.1 million. Despite beating analyst estimates on both the top and bottom lines, the company’s stock plummeted more than 22% in after-hours trading. This sharp

Via MarketMinute · March 6, 2026

Via MarketBeat · March 6, 2026

TrueShares CEO Mike Loukas says autocallable ETFs are a "game changer," as the fast-growing income strategy approaches $1B in assets.

Via Benzinga · March 6, 2026

The first quarter of 2026 has revealed a stark divergence in the American deal-making landscape, characterized by a "K-shaped" resilience that favors the boldest and largest players. While the broader mergers and acquisitions (M&A) market continues to grapple with a persistent "mid-market bottleneck" driven by elevated financing costs and

Via MarketMinute · March 6, 2026

BELLEVUE, WA — In a strategic move to capitalize on Apple Inc.’s (NASDAQ: AAPL) mid-cycle hardware refresh, T-Mobile US, Inc. (NASDAQ: TMUS) has announced a sweeping set of promotional offers for the newly released iPhone 17e and M4 iPad Air. The "Spring Surge" campaign, launched today, March 6, 2026, marks

Via MarketMinute · March 6, 2026

As of March 6, 2026, the industrial and telecommunications sectors are witnessing a historic transformation, and few companies embody this shift more than Dycom Industries (NYSE: DY). While many infrastructure players struggled with the high-interest-rate environment of the mid-2020s, Dycom leveraged a pivotal "breakout" year in 2025 to solidify its position as the premier specialty [...]

Via Finterra · March 6, 2026

SANTA CLARA, CA – Advanced Micro Devices, Inc. (Nasdaq: AMD) has officially moved to colonize the next frontier of the personal computing market, announcing a sweeping expansion of its Ryzen AI 400 series processors. Following a high-profile series of reveals at the Mobile World Congress (MWC) 2026 earlier this week, the

Via MarketMinute · March 6, 2026

Via Benzinga · March 6, 2026

Via Benzinga · March 6, 2026

As of March 6, 2026, the global mining landscape remains defined by the aftershocks of the most significant M&A drama in recent decades: BHP Group’s (NYSE: BHP; ASX: BHP) unsuccessful pursuit of Anglo American. Nearly two years after the rejection of its third and final formal bid in May 2024, BHP stands at a crossroads. [...]

Via Finterra · March 6, 2026

Despite delivering a staggering "blowout" fourth-quarter earnings report that exceeded even the most bullish Wall Street forecasts, NVIDIA (NASDAQ: NVDA) has found itself navigating a period of intense volatility. In the days following its February 25, 2026, financial disclosure, the semiconductor giant witnessed a sharp 14.2% decline from its

Via MarketMinute · March 6, 2026

Today’s Date: March 6, 2026 Introduction As we enter the spring of 2026, Starbucks Corporation (NASDAQ:SBUX) stands at one of the most critical crossroads in its 55-year history. After a tumultuous period characterized by leadership churn, cooling demand in its two largest markets, and a bruising identity crisis, the "Green Giant" of Seattle is midway [...]

Via Finterra · March 6, 2026

On March 5, 2026, retail giant Costco Wholesale Corporation (NASDAQ:COST) released its fiscal second-quarter earnings, once again silencing skeptics who questioned whether the warehouse club could maintain its momentum. The company reported a significant beat on both the top and bottom lines, driven by a surge in digital sales

Via MarketMinute · March 6, 2026

Marvell Technology (NASDAQ: MRVL) shares ignited a rally in pre-market trading on Friday, March 6, 2026, following a fourth-quarter earnings report that shattered Wall Street expectations and positioned the semiconductor giant at the vanguard of the artificial intelligence infrastructure boom. The company reported record-breaking quarterly revenue of $2.219 billion,

Via MarketMinute · March 6, 2026

As of March 6, 2026, the semiconductor landscape is witnessing a remarkable resurgence of a legacy powerhouse. Microchip Technology (Nasdaq: MCHP), a stalwart in the embedded control market, has transitioned from a period of intense cyclical pressure to a phase of renewed stock momentum. After navigating a grueling inventory correction throughout 2024 and 2025, the [...]

Via Finterra · March 6, 2026